KAYA

The Kapital Access for Young Agripreneurs (KAYA) Loan Program offers zero-interest loans of up to Php 500,000 (subject to approval of PLC) payable up to 5 years. Borrowers must be 18 to 30 years old, and are graduates of either formal or non-formal schooling (including but not limited to graduates of agriculture and fishery related degrees from higher education institutions, DA and ATI-accredited programs, TESDA programs, farm schools, and secondary schools with agriculture and fishery-related courses).

Ang Kapital Access for Young Agripreneurs (KAYA) Loan Program ay nagbibigay ng pautang na walang interes hanggang Php 500,000 (subject to approval of PLC) na maaaring babayaran sa loob ng limang (5) taon. Kinakailangang 18-30 years old ang borrowers, at nakapagtapos ng pormal o di-pormal na kurso na may kinalaman sa pagsasaka o pangingisda (kasama dito ang college diploma, o training certificate mula sa DA, ATI, TESDA, o farm schools).

Eligibility Requirements

- One (1) Valid Government-issued ID with Picture

- Loan Application Form (During Loan Process)

- Simple Business Plan

- Certificate of Agri-Fishery Related Course/Training

Eligible Borrowers

- Young agripreneurs aged 18 to 30 years old at the time of application

- Graduates of an agri-fishery-related course (diploma) or training course (certificate of completion)

- Registered in the Registry for Basic Sectors in Agriculture (RSBSA) or the Farmers and Fisherfolk Enterprise Development Information System (FFEDIS)

Eligible Loan Purpose

To finance the capital requirements of start-up or existing Agri-based business enterprises, such as working capital, acquisition of machineries and equipment, and facilities.

Loan Features

- Loanable amount of up to Php 500,000 per borrower (subject to approval of the PLC)

- 0% interest; partner lending conduit may charge a one-time service fee of up to 3.5%

- Loan term of up to 5 years depending on the projected cash flow

ANYO

The Agri-Negosyo (ANYO) Loan Program offers zero interest loans for Small Farmers and Fishers (SFF) and registered Micro and Small agri-fishery Enterprises (MSEs) which may be sole proprietors, partnerships, corporations, associations and cooperatives. Eligible individual SFF borrowers may avail a maximum loanable amount of Php 300,000 while registered MSEs, depending on its size, may borrow a loan amount of up to Php 15 million (subject to approval of PLC). Loans are payable up to 5 years.

Ang Agri-Negosyo (ANYO) Loan Program ay nagbibigay ng pautang para sa working capital ng mga maliliit na magsasaka at mangisda at rehistradong micro and small agri-fishery enterprises na maaaring sole proprietors, partnerships, korporasyon, asosasyon, o kooperatiba. Ang mga maliliit na magsasaka at mangingisda ay maaaring umutang hanggang P300,000 samantalang ang rehistradong enterprise, depende sa laki ng assets nito, ay maaring makahiram ng hanggang Php 15 million (subject to approval of PLC). Ang nahiram ay maaaring bayaran hanggang 5 taon.

Eligible Borrowers

Small Farmers & Fisherfolk (SFF)

- Registered or enrolled under the Registry System for Basic Sectors in Agriculture (RSBSA).

Overseas Filipino Worker (OFW)

- Certified by OWWA to have lost their overseas employment, repatriated or unable to return to their overseas employment due to the COVID-19 pandemic.

Micro and Small Enterprises (MSE) Borrower

- MSEs are defined as those engaged in/with existing production, processing, marketing and or distribution of agri-fishery produce/products/commodities and farm inputs. It may be a single proprietorship, partnership, corporation or cooperative/association.

Farmer and Fisherfolk Organization/Association

- Registered entities whose members are farmers and fisherfolk.

Loan Features

- Loanable amount of Php 300,000 up to Php 15 million per borrower (subject to approval of the PLC)

- 0% interest; partner lending conduit may charge a one-time service fee of up to 3.5%

- No collateral

- Loan term of up to 5 years depending on the projected cash flow

Eligible Loan Purpose

- Production

- Distribution

- Acquisition of machinery/Equipment

- Construction of Facility/ies

- Processing

- Marketing

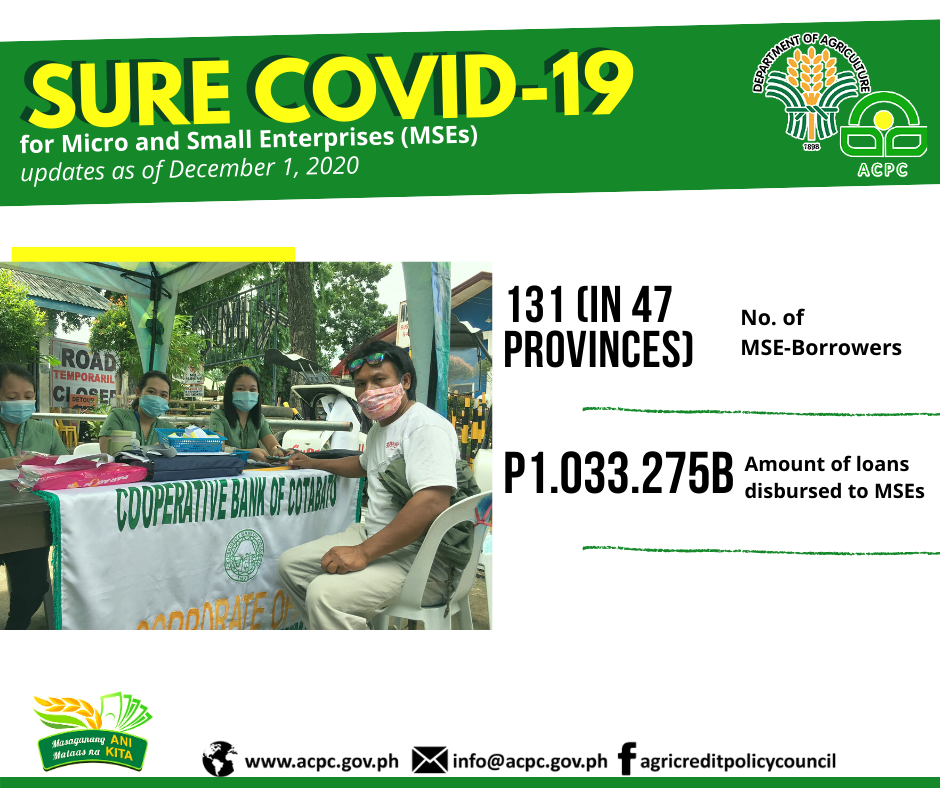

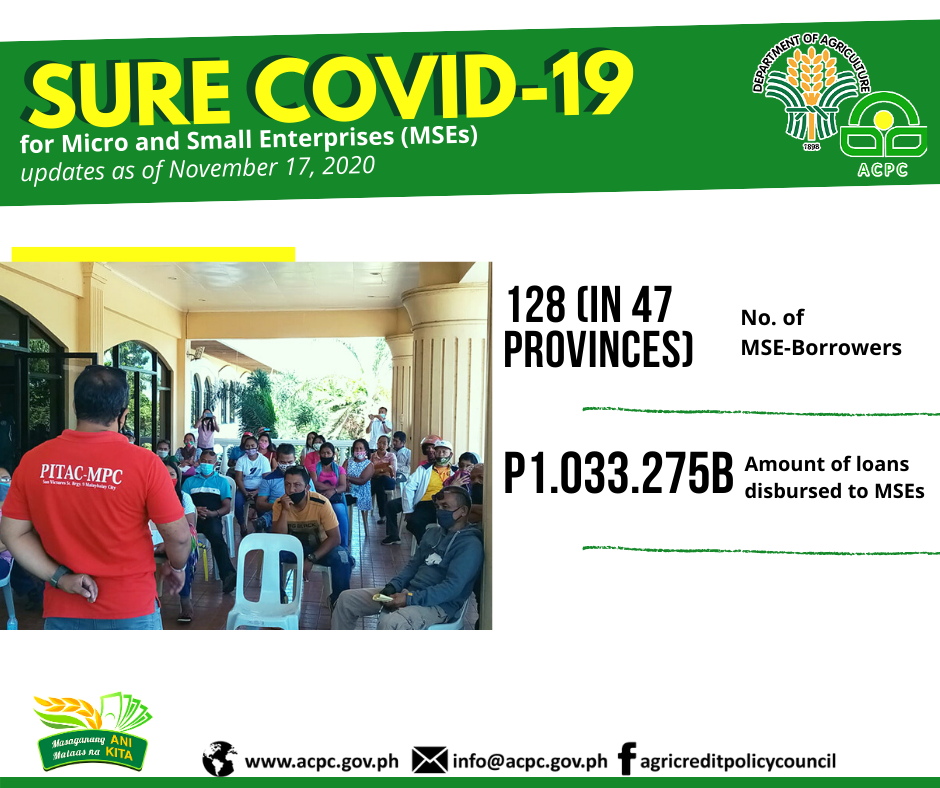

SURE COVID-19 for Micro and Small Enterprises (MSEs)

The Expanded SURE Aid and Recovery Project (SURE COVID-19) for Micro and Small Enterprises (MSEs) provides working capital loans to agricultural/fishery/livestock MSEs, cooperatives, and associations to continue operations and ensure the availability of food supply amid the COVID-19 pandemic and . Eligible enterprises may avail of zero-interest loans of up to Php 10 million, payable in five (5) years.

Ang Expanded SURE Aid and Recovery Project (SURE COVID-19) para sa Micro and Small Enterprises (MSEs) ay nagbibigay ng working capital loans para sa mga agricultural/fishery/livestock MSEs, kooperatiba, at asosasyon upang maipagpatuloy ang kanilang operasyon at matugunan ang kakulangan sa suplay ng pagkain sa gitna ng pandemya ng COVID-19. Ang mga eligible na enterprises ay maaring makautang ng hanggang Php 10 million nang walang interes at babayarin sa loob ng limang (5) taon.

ELIGIBLE BORROWERS:

Agri-Fishery-based micro and small enterprises (MSEs) that are willing to deliver /supply to DA-KADIWA Ni Ani at Kita centers and consumers of high consumption markets such as Metro Manila and other demand centers.

ELIGIBLE LOAN PURPOSE:

Purchase of agri-fishery produce/products/commodities from farmers and fisherfolk; Defray transportation costs of delivery to market; Payments of wages for emergency workers hired in the delivery and selling (drivers, sellers, helpers); Processing and/or semi-processing of agri-fishery produce; Trading/manufacturing of agri-input supplies/equipment; Other supply chain activities

LOAN FEATURES:

Loanable amount of up to PhP 10.00 Million per borrower depending on the financial requirements (subject to approval of the PLC); 0% interest; partner lending conduit may charge a one-time service fee of up to 3%; No collateral; Loan term of up to 5 years depending on the projected cash flow

- All

- Testimonies

- Summary

- Orientation

ACPC LOAN PROGRAMS 6-STEP LOAN AVAILMENT PROCESS

| Step 1 | Step 2 | Step 3 | Step 4 | Step 5 | Step 6 |

|---|---|---|---|---|---|

|

|

|

|

|

|

| Sign-up and Create Account | Schedule and Attend Online Program Briefing | Select Loan Facility and Complete Documentary Requirements | Schedule & Attend Business Planning Workshop | Packaging of Business Proposal & Referral to Partner Lending Conduit (PLC) | Processing, Evaluation & Credit Decision by PLC |